Navigating the Cryptic Nature of Currency in Human Trafficking

"Follow the money." We have all heard it at some point, especially if you are in the anti-human trafficking space. Yet, if only it was THAT simple. Let's pull this apart.

Recently, I found myself in a bustling coffee shop, engrossed in my weekly ritual of crafting an endless to-do list. Across from me sat an elderly gentleman, drawn by the stickers adorning the back of my laptop. Curious about my line of work, he interrupted my thoughts with a question. When I mentioned that I train on identifying and disrupting criminal networks, particularly human trafficking, he interjected with a familiar phrase: "Ah, yes, follow the money, right?"

As I shook my head, eager to resume my musings, his words lingered in my mind. Was it truly that straightforward?

"I frequently remind myself to refrain from overanalyzing," I often muse, yet it seems that my natural inclination towards the term "analyst" resonates deeply within me for precisely this reason.

Let’s start with understanding the basic fundamentals of human trafficking, and then we can jump into the investigation side of things. Language is critical, especially when describing serious crimes and their weight. According to a report by the UNODC, human trafficking is a financially-motivated crime. A sex trafficker is seeking financial gain and will exploit their victims to gain a profit. While a predator is seeking sexual gratification and will exploit their victims to satisfy their sexual desires and fantasies. Amid efforts to combat human trafficking networks, simply "following the money” hides a web of complexities that law enforcement agencies, policymakers, and advocates grapple with in their pursuit of justice. The financial aspect of human trafficking investigations is integral, serving as both a means to dismantle criminal networks and a tool for prevention. By tracing the flow of money, authorities can uncover key players, identify victims, and disrupt the operations of traffickers. Nevertheless, the reality of following the money in these cases is far from simple.

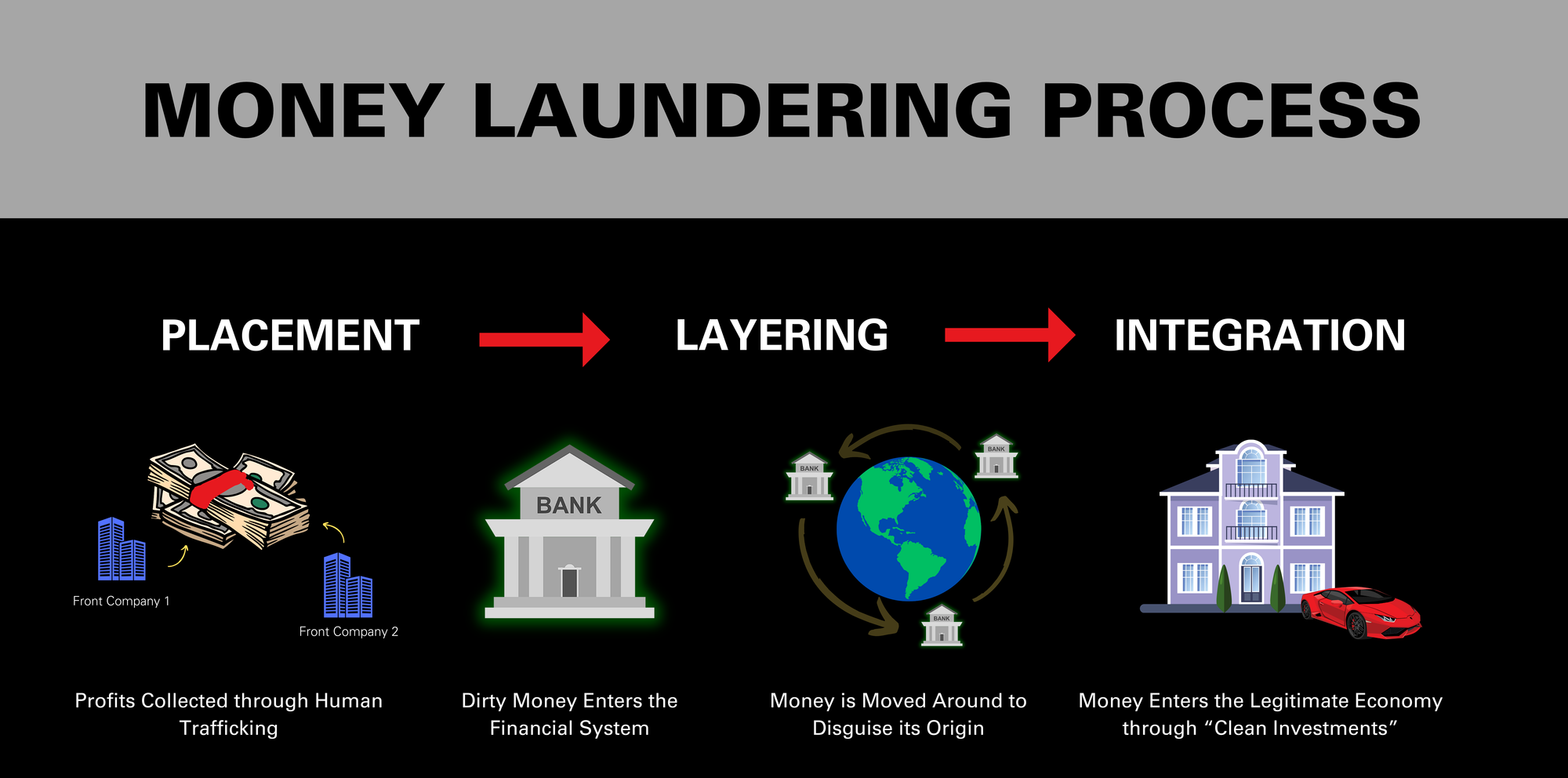

One of the primary challenges stems from the clandestine nature of trafficking networks. Unlike other criminal enterprises, such as drug trafficking or money laundering, where financial transactions may leave digital footprints or paper trails, human traffickers may thrive and operate in cash-dominated economies. This cash-centric system makes it arduous to track illicit proceeds, as transactions occur off the radar of traditional financial institutions. Traffickers often employ sophisticated tactics to obscure their financial activities, including the use of shell companies, front businesses, and informal money transfer systems. Making human trafficking a nexus crime in many criminal networks, they exploit gaps in regulatory frameworks and exploit vulnerabilities in financial systems to evade detection. This complexity necessitates a multifaceted approach that combines financial intelligence, forensic accounting, and collaboration across jurisdictions. Globally, we have yet to fully understand or master any of these strategies.

Simply, this is not a one-size-fits-all knot of crime. Identifying and dissecting the financial flows within these sectors requires specialized knowledge and resources in that specific industry. This knot requires heavy demands from the active coordination between law enforcement agencies, financial institutions, countries/jurisdictions, policymakers, and industry stakeholders to gather information, compile actionable intelligence, and coordinate in order to disrupt the flow of illicit funds. In addition to the challenges posed by traffickers' tactics and the diversity of industries involved, there are legal and ethical considerations that further complicate financial investigations. Privacy laws, banking regulations, and international treaties impose constraints on the collection and sharing of financial data across borders. Balancing the imperative to combat trafficking with the protection of individuals' rights and financial privacy presents a delicate dilemma for investigators and policymakers alike.

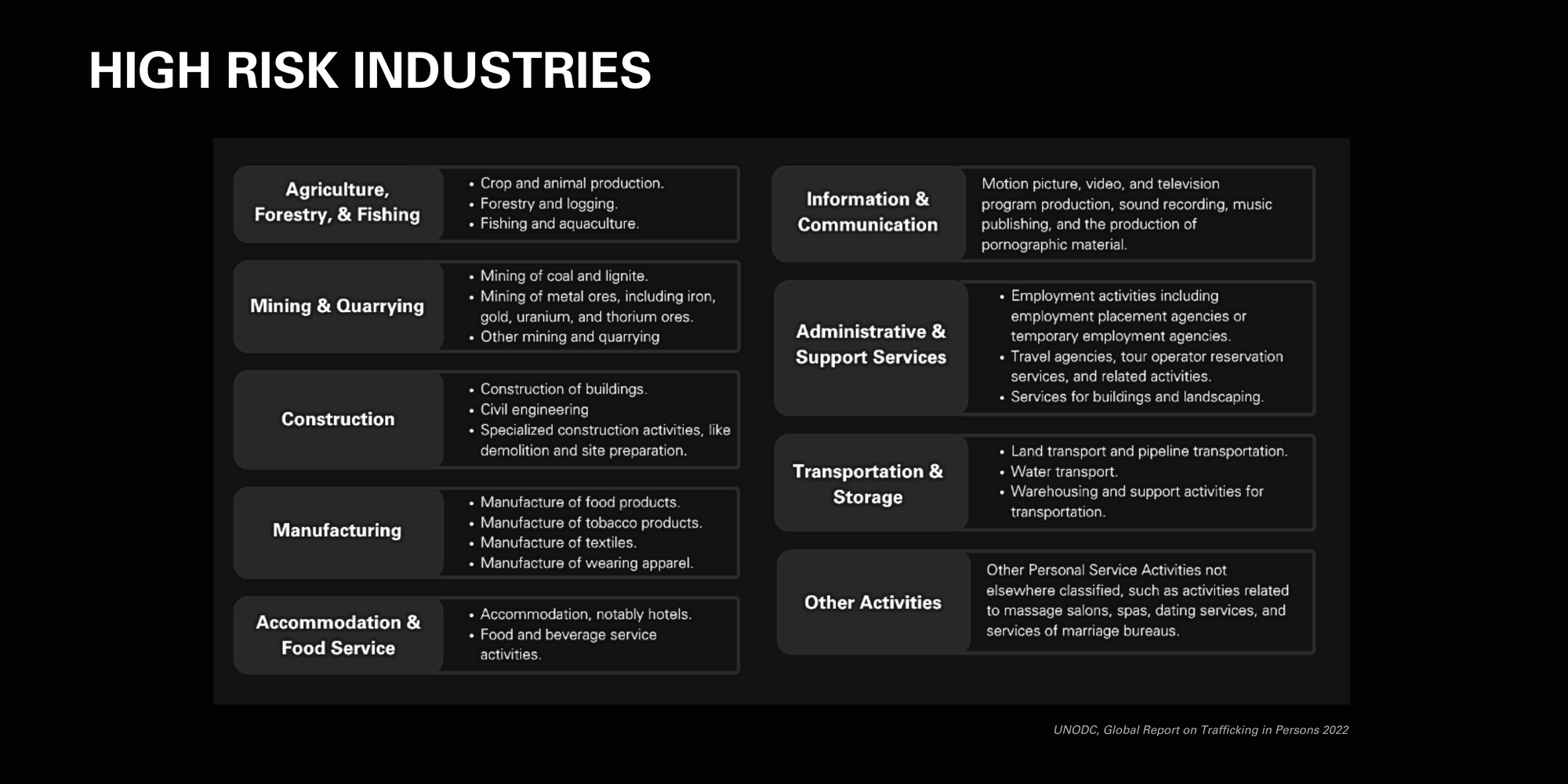

Risk-based Strategy

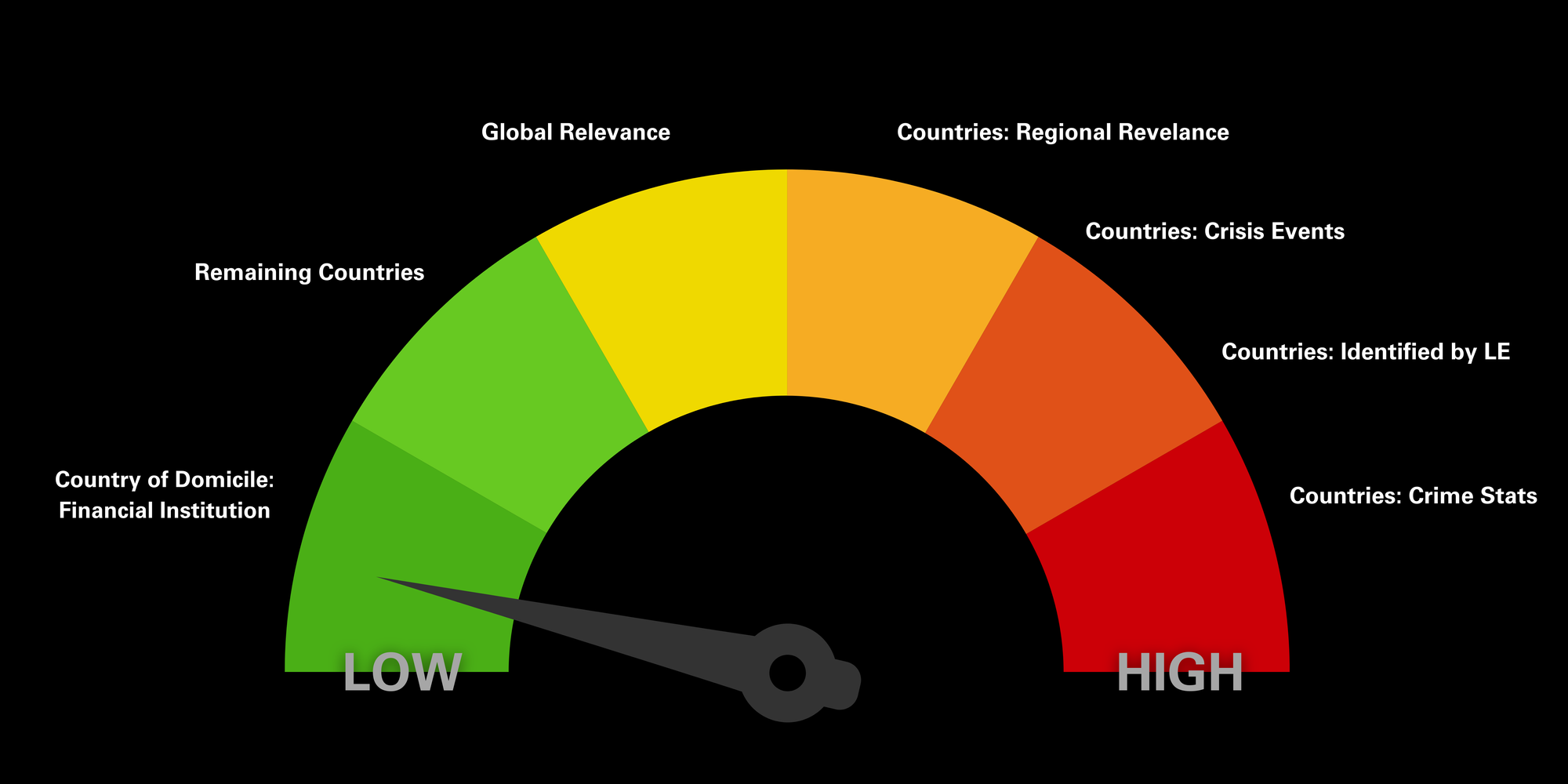

Human trafficking intersects with various industries, complicating efforts to untangle the financial threads and solidify processes for detection. However, certain industries appear to be more vulnerable to human trafficking. Often, criminals engage in human trafficking due to the low risk and high profits of the trade, and that risk threshold really depends on the countries and industries they are exploiting. Therefore, using a risk-based process could enhance capabilities.

Assessing Risk Levels

I'm not one to rely heavily on statistics unless I can see the raw data firsthand, but statistics are a great first step in identifying high-risk countries and industries when monitoring their data flows. Human trafficking is very innovative and constantly changing, so the statistics and classifications should be kept up to date to be useful in this approach.

High-risk country and/or high-risk industry elements should lead to a designation of relevant clients. Based on their business and risk profile, financial institutions may decide that they only want to make such a designation if a client has links to both high-risk countries and high-risk industries. Alternatively, the isolated presence of a specific country or industry may be deemed sufficient for such a classification. With such a procedure, however, corresponding policies must be kept up to date, and responsible employees must be sufficiently trained so that human trafficking risks are identified.

Comprehensive Integration Processes

The process of identifying high-risk clients involved in organized crime or, in this case, human trafficking should be seamlessly integrated into the customer due diligence or CDD protocol. This integration should trigger the application of rigorous enhanced due diligence measures. These measures should closely resemble those applied to high-risk clients, which typically include more frequent reviews of client data. As part of the specific EDD procedures aimed at combating human trafficking, compliance departments should conduct thorough open-source investigations. This entails conducting comprehensive online research to ascertain any potential connections between the client and illicit activities related to human trafficking. These investigators should have a firm understanding of the profile of a trafficker, their modus operandi, and the potential red flags in their activities.

Expanding on this, the search for potential indicators of human trafficking involvement should not be limited to surface-level investigations. Rather, it should delve into various online platforms, including social media networks, forums, and online marketplaces, where evidence of exploitation or suspicious activities may surface. Additionally, compliance teams should remain vigilant for red flags such as unusual financial transactions, discrepancies in personal information, or unexplained wealth that could signify involvement in human trafficking networks. You can see where there will need to be coordination across specialties and disciplines.

When a client is deemed high-risk for money laundering, the compliance employee assigned must clearly understand that the client under scrutiny is not solely being examined due to a flagged indicator suggesting potential money laundering activities. Alongside providing explanatory text for the indicator related to money laundering, it's imperative to explicitly reference possible implications for human trafficking and other forms of exploitation.

When a client is deemed high-risk for money laundering, the compliance employee assigned must clearly understand that the client under scrutiny is not solely being examined due to a flagged indicator suggesting potential money laundering activities. Alongside providing explanatory text for the indicator related to money laundering, it's imperative to explicitly reference possible implications for human trafficking and other forms of exploitation.

Monitoring Transaction Behavior

Criminals are adept at adjusting their operations in response to changing circumstances. Short-term crises such as war, famine, natural disasters, or economic downturns can result in a surge in the number of victims originating from the affected areas. This increase may occur because victims, driven by desperation, are more susceptible to the promises made by perpetrators or find themselves vulnerable while attempting to flee the country. It is anticipated that regions experiencing a concentration of criminal activities during such crises will witness a corresponding rise in financial flows into and out of these areas, as well as neighboring regions. Consequently, customers whose transactional activities exhibit a significant increase in frequency or volume during a crisis should be identified and evaluated for potential involvement in modern slavery or human trafficking activities.

The rise of criminal networks and disparities in society have resulted in certain geographic areas being disproportionately targeted for human trafficking. In some cases, specific cities are identified as frequent points of origin or destination for victims of these crimes. It's beneficial to screen for these locations to leverage this understanding in transaction monitoring. Payment instructions accompanying transactions often contain data on the residence of both the sender and recipient. By analyzing this information, banks can monitor not only the transactions of their own account holders but also those involving customers of foreign banks.

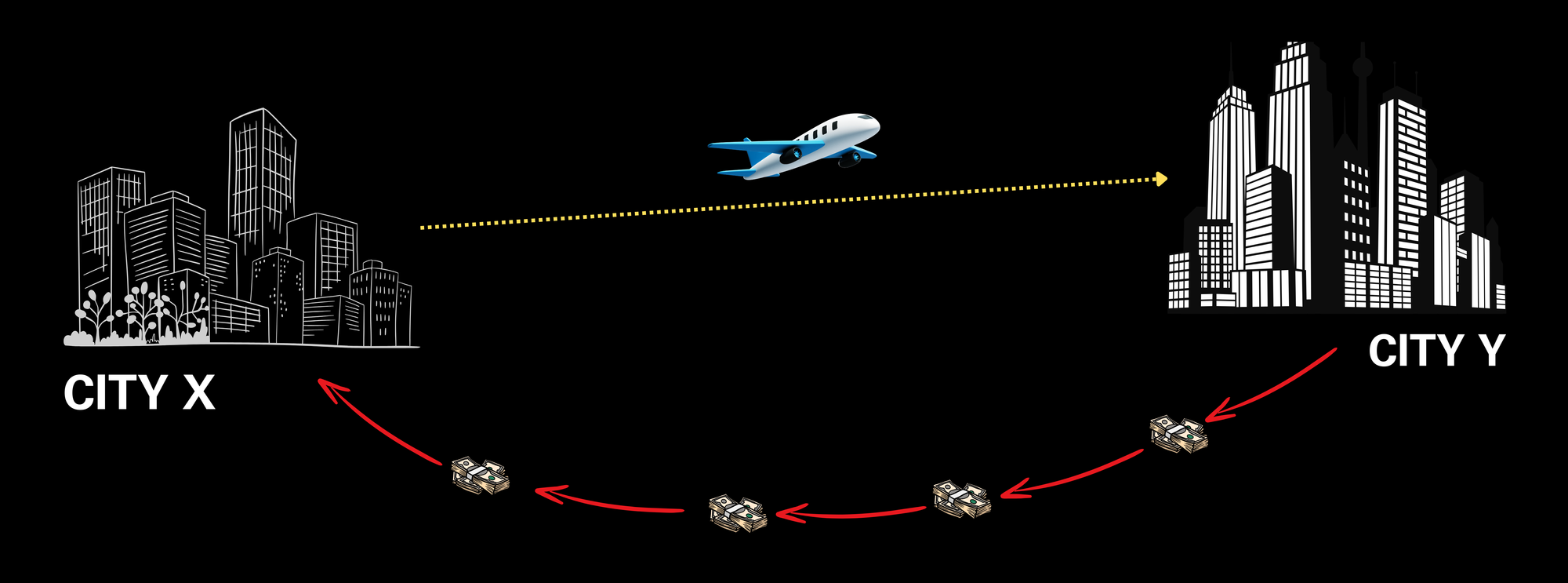

When implementing risk-based transaction monitoring, it's crucial to incorporate the screening of location data. But, it's important to understand that transaction monitoring primarily examines the financial transactions associated with trafficking activities, rather than the trafficking itself. Typically, payments move counter to the flow of goods traded. For instance, if individuals are trafficked from Country 1 to Country 2, closer scrutiny should be applied to the corresponding financial flows from 2 to 1.

In addressing the complexities of human trafficking, a scenario such as victims being trafficked from City X to City Y for forced labor underscores the importance of monitoring financial transactions closely. For example, let's consider a scenario where victims from City X are trafficked to City Y for forced labor. While the physical movement of victims may occur from City X to City Y, the financial transactions, such as payments made to recruitment agencies or traffickers, may flow from City Y back to City X. These financial transactions, if monitored closely, could reveal patterns indicative of trafficking activities, such as large sums of money being transferred to accounts in City X known for exploitation networks.

While physical movements may occur between these cities, the flow of financial transactions, such as payments to recruitment agencies or traffickers, often moves in the opposite direction. By scrutinizing these transactions, patterns indicative of trafficking activities, such as large sums of money being transferred to accounts in City X associated with exploitation networks, can be revealed. This necessitates a holistic approach that goes beyond traditional law enforcement tactics, emphasizing cross-sector collaboration, technological advancements, and enhanced data analytics. Engaging with financial institutions and private sector partners to strengthen anti-money laundering measures and transparency in supply chains is imperative. Recognizing that unraveling the financial intricacies of human trafficking is a dynamic and evolving endeavor marked by sustained commitment, collaboration, and innovation is essential in combating this grave violation of human rights and fostering a future free from exploitation and injustice.

We are Only Skimming the Surface

The scope of financial investigations in the context of human trafficking extends far beyond simply following the money trail. In addition to tracing financial transactions, numerous additional strategies and aspects must be considered. Everything mentioned in this article only scratches the surface of the complexities involved in financial investigations related to human trafficking. The interplay between various factors, such as client behavior, regulatory compliance, and transaction classification, creates a web of intricacies that require careful navigation and expertise. This is without introducing the complexity of the psychological factors to consider from the client's angle and also the trafficked persons as well. The layers of obfuscation and lies that both have orchestrated only add to the difficulty of policing entities understanding the depths of these types of investigations.

Client profiling plays a crucial role in identifying suspicious activity and potential involvement in human trafficking networks. This involves analyzing various characteristics and behaviors of clients to detect patterns indicative of illicit activity. Furthermore, ensuring compliance with sanctions regimes is essential in preventing the flow of funds to individuals or entities associated with human trafficking. This requires thorough screening of clients and transactions against relevant sanction lists and regulatory requirements. Then there is the process of classification and identification is another integral component of financial investigations. This entails categorizing transactions based on their risk level and identifying indicators of human trafficking or related criminal activity. By classifying transactions effectively, investigators can prioritize resources and focus their efforts on high-risk areas.

I'll end this with one final thought: Financial investigations or just “following the money" only represent a singular complex angle of a poly-faceted sisasystem within the broader multidisciplinary approach to combating human trafficking. This highlights the need for collaboration and integration across different fields and sectors. Indeed, the complexity and interconnectedness of these issues underscore the importance of comprehensive strategies and concerted efforts in addressing the scourge of human trafficking more effectively.